Tax Abatement is a program whose rules, while largely misunderstood, have been a game-changer for the City.

First implemented in the early 1990’s, the abatement program was designed to be an incentive to owners and developers to improve or renovate dilapidated properties. By forgoing taxes on the improved value of the properties, the City was effectively taxing the properties as if they were still in their blighted condition. Although it took a while for the program to catch on, it is now a pillar of the redevelopment and renovation community.

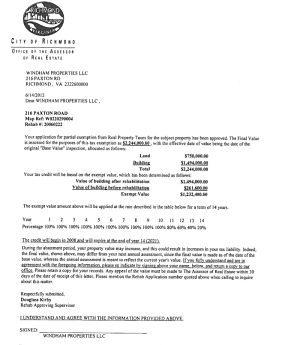

The basic rules of the abatement provide the owner of a property an exemption on the taxable value associated with the improvements made to the property. The reduction in taxes is for a fixed period of time (not in perpetuity as it is in some markets) and can vary from 10-15 years depending on several factors. Applying some numbers, imagine a blighted property that is in need of major repair with an assessment of $100,000. Assuming that the owner renovated the property back to market value by spending $250,000, the property would still be taxed as if it was only was worth the original $100,000 for roughly the next 7-10 years. The savings in real estate taxes (at the current rate of 1.2%) on $250,000 for 10 years is $30,000.

That is a great incentive, especially when applied to investment properties.

While the saving for the owner is a loss to the City, the thinking is that any city full of blighted properties means a city losing out on revenue for the restaurants, coffee shops, boutiques, markets and bars. A city with renovated properties means a city that is alive and vibrant with taxable revenues flowing in via other sources.

Tax Abatement has been one of the many programs that has been almost immeasurable in its effect on bringing life back to the urban core.

About the Writer // Scott Garnett is a 20 year brokerage veteran, multi-year Distinguished Achiever within the RAR and Fan District resident. He is also a staunch advocate and catalyst for the redevelopment of Historic Broad Street.